The hold cost of your investment property is simply the cost of owning it. To ensure your investment is working in your favour, the rental income your property earns must always offset the other costs associated with your investment.

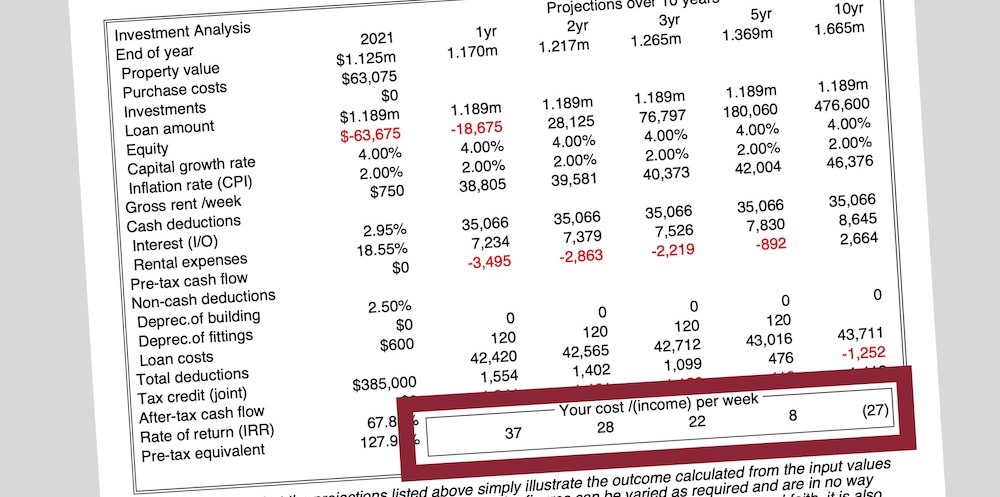

A Property Investment Analysis (PIA) is a tool that we use to calculate the weekly hold cost of an investment property – prior to purchase.

Many investors make the mistake of relying on back of the envelope calculations, using the annual rental return and the purchase price to get an idea of what the hold cost will be.

This is a very unreliable method of analysing the return and hold cost of an investment property. Why? It provides a simple percentage return figure. This can quite easily be as high as 5% in the present market. Factor in overheads, depreciation and the rest… and 5% gross return can easily be reduced to 3.5% nett return. That’s well below par in the current residential climate.

The unrealistic outcome of this calculation may mean that you pay more for the property than a savvy investor would. Life’s too short for that kind of regret.

A PIA tells you what it will cost to hold the property

Wise investors complete a proper Property Investment Analysis before they think about making an offer on a property or attend an auction. It allows them to see exactly how much money they will need to pay weekly and clearly see what, or if there will be, a shortfall between the rental income, mortgage costs and other outgoings (which often get left out of back of the envelope calculations).

IPB’s PIA accounts for all income and expenses related to the property and purchase, including deductions and personal information such as:

- Stamp Duty

- Rates and water

- Owners Corporation

- Property management fees

- Insurances

- Current interest rate with a buffer built in

- Amount of mortgage

- Loan costs

- Conveyancing charges

- Buyers Advocate Fees

- Depreciation on building and fittings

- Rent

- Contingencies

- Inflation rate

- Your income for tax credits

It is able to cater to and provide detailed information about the financial implications of purchases in one or two names, catering for individual incomes of buyers and also has an SMSF component.

Accounting for vacancy in your calculations

The other key factor to get right is the estimated rental return. Vacancy is the enemy of any property investor and should be allowed for in your PIA – especially if you are buying a vacant property. While the agent will offer advice as to what the weekly rent may be, you need to d0 your own research (they are selling the property, not renting it, so may tell you what you want to hear).

At IPB we rely on the REIV data base to provide an informed estimate of weekly rental. If you don’t have access to the database you can call a property manager you already trust and ask their opinion as they will have access to the database. You can also look online for other similar, local properties currently being advertised for rent to form an accurate opinion of your expected rental income.

Perform a Property Investment Analysis before you purchase

For peace of mind – and a better property investment portfolio – know your hold cost before you purchase. When you know your hold cost you’ll know what you need to budget for. It can even affect your decision to purchase the property or not, or at the very least how much you are willing to pay for it.

If you are considering purchasing an investment property to add to your portfolio and would like to understand how a buyers advocate and a PIA can help you buy smarter, get in touch.